News

Notice of Public Hearing - By-law to Amend the Land use By-law 26-01 and the By-law to Amend the Land Use By-law 26-02

- Details

A Public Hearing regarding the By-law to Amend the Land use By-law 26-01 and the By-law to Amend the Land Use By-law 26-02 for the Municipality of Cumberland will be held at 4 pm, Wednesday, February 18th, 2026, in the Council Chambers of the Upper Nappan Service Centre.

Note that this meeting may be rescheduled or conducted online, visit cumberlandcounty.ns.ca to verify meeting schedule.

By-law to Amend the Land Use By-law 26-01

- Rezone PID 25244914, 150 Junction Rd., Springhill from Mixed-use (CMix) Zone to General Commercial (CGen) Zone.

By-law to Amend the Land Use By-law 26-02

- Rezone a portion of PID 25144049, 3544 Kolbec Rd., Port Howe from Agriculture (AG) Zone to Commercial Recreation (CRec) Zone.

Hearing documents can be viewed at plancumberland.ca/hearings or by contacting our office at 902-667-2313.

Public Hearings are open to the public.

You may participate by submitting comments by email to:

MPS and Land Use Bylaw Review Open House Sessions Reschedule for Monday, February 2

- Details

Due to the impending weather forecast, all Municipal Planning Strategy & Land Use By-law Review open house sessions planned for Monday, February 2 will be rescheduled. New dates and times will be shared as soon as they are confirmed. Thank you for your understanding.

Tax Sale on March 3, 2026

- Details

Notice is hereby given that the following described lands and premises, situated in the Municipality of Cumberland will be sold at Public Auction by the Treasurer of the Municipality of Cumberland unless such taxes, interest and expenses are paid in full before the date of the sale.

The Public Auction will be held at the Dr. Carson & Marion Murray Community Centre located at 6 Main St., Springhill, NS on March 3, 2026, at 10 am, bidder registration will begin at 9 am.

Terms of the sale: Cash, money order, certified cheque, lawyer’s trust cheque or debit card – amount to equal the total due for the property noted below – to be paid at the time of the sale, plus $200 to register the Certificate of Sale and prepare the Tax Deed. If paying by debit, verify your available daily limit before the date of the sale. The balance of the purchase price, if any, is to be paid similarly within three business days of the sale.

Please Note: The auction will pause after each property is sold to collect successful purchaser information and payment of the total due listed below and administrative fee of $200 – purchasers are expected to have these funds with them, if you are unable to pay immediately the property will be put back up for sale.

The Municipality of Cumberland makes no representations or warrantees to any purchaser regarding the fitness, geophysical or environmental suitability of the land (s) and/or premises offered for sale for any particular use and are being sold on an “as is” basis only. Although the Municipality has made all reasonable efforts to confirm ownership, it does not guarantee title or boundaries of the properties listed.

Prospective Purchasers are responsible to conduct their own searches and surveys or other investigations. Commercial properties and land are subject to HST which is calculated on the purchase price.

In accordance with the Municipality of Cumberland Revenue Collection Policy 18-05, section 9 states that the Municipality will not accept a tender/bid from a tax assessed owner, his/her agent, or his/her immediate family for any sum less than the full amount of taxes, interest and expenses associated with respect to the land.

For a more detailed description please contact the Municipal Building at 1395 Blair Lake Road, Phone 902-667-2313, Toll Free 1-888-756-6262 or visit our website at https://www.cumberlandcounty.ns.ca/tax-sales.html

Tax Sale Frequently Asked Qustions

1. How do I bid? What do the bids start at?

You need to attend the auction to bid. You will register and you will be given a bidder sheet with your bidder number on it. Typically our office uses an auctioneer for the tax sales. They will start the bidding at the property’s total taxes and expenses due, unless a minimum bid has been authorized by Council. If you want to bid on a property, you raise your card. Depending on the interest in a property the auctioneer will call for a higher bid or you can call out a higher amount. We will continue this process until the highest bid wins.

2. How much money is required up front and when do I have to pay?

You need to come to the sale prepared to pay the property’s total taxes and expenses due, unless a minimum bid is stated. You also need to have $200.00 to cover the cost associated with preparing the certificates of sale and tax deed. For example, if the minimum bid is $1,000.00 and you are the successful bidder at $5,000.00, you must pay $1,000.00 + $200.00 on the day of the sale. The remaining $4,000.00 must be paid within 3 (three) business days.

Once a property is auctioned and sold, the tax sale will be paused, and the successful bidder will be required to proceed to the cashier for immediate payment of the minimum bid and $200 fee. Any amount above this is due within 3 (three) business days. We will not hold the sale for you to call your bank or run to get money. In the event that you have not made prior arrangements for payment, your bid will be null and void and the property will be re-auctioned right away.

3. Does it cost anything to register? Or does it cost anything to bid?

No, the only fee required at the sale is a $200.00 administrative fee, which is payable if you are the successful bidder. This applies to each property you purchase.

4. How can I pay?

Acceptable payment methods: cash, debit, certified cheque or money order, bank draft, or lawyer’s trust cheque to cover taxes, interest and expenses, must be made at the time of the sale. The balance of the purchase price, if any, must be made within three (3) business days of the sale in similar form of payment.

5. Who do I make the cheque out to?

The Municipality of the County of Cumberland

6. What if I can not attend the sale?

If you can not attend the auction in person, you can have someone attend the auction to bid on your behalf. This individual must come prepared with the required funds in acceptable form.

7. When do I pay HST?

HST is paid on the purchase price of vacant land or commercially assessed property. This amount is to be paid within 3 (three) business days of the sale. You may also pay at the time of the sale.

8. If I am a successful bidder, what happens if I fail to make full payment within 3 business days of the sale?

If the balance of your bid is not made within 3 (three) business days, your bid will be null and void and the property will go back to the next tax sale. The expenses of the resale will be deducted from the deposit and only once the property is successfully sold will your deposit less expenses of the resale be refunded.

As per the MGA: Section 148. Payment of Purchase Money 3. Where the balance of the purchase money is not paid within three business days, the land shall again be advertised and put up for sale. 4. The expenses of the resale shall be deducted from the deposit, and the balance shall be refunded after the resale is held. 1998, c. 18, s. 148; 2004, c. 7, s. 9; 2025, c. 17, s. 27.”

9. What happens if I change my mind after purchasing a tax sale property and no longer want it?

Properties are sold on an “as is, where is” basis. NO REFUNDS will be issued after the payment is processed. The property will be transferred into your name, when permitted, and it will be your responsibility for the resale. You are buying property and should do you own research before bidding. It is recommended that bidders view the files on the properties that are at our Upper Nappan Service Center and on our website before the date of the sale. You may also drive by the property and view from the road.

By participating in a tax sale, you are acknowledging that you have satisfied yourself about what it is that you are bidding upon, that the process leading up to your bid has been conducted properly and that you will not hold the Municipality responsible if there later proves to be a title, survey or other property issue.

10. Can I view the property?

The Municipality of Cumberland does not own the properties on the tax sale list. The properties are privately owned. The Municipality does not authorize you to go onto or enter the premises just because it is on the tax sale list. You will be purchasing where is, as is. You may wish to drive by the property or research through viewpoint or google maps.

11. What does redeemable and non-redeemable mean?

Redeemable means the property owner has 6 months that they can redeem the property.

If the property owner redeems the property, the purchaser will receive their full purchase price back with interest at a rate of 10% from the date of the sale to the date of redemption.

Non-redeemable means that the owner does not have a redemption period to buy back the property. A certificate of sale and tax deed will be prepared for you as the successful bidder.

12. Who can redeem a property?

Persons with a vested interest in the property can redeem. An owner and a mortgage company listed can redeem.

13. What are my rights as the new owner if there is a 6 month right of redemption?

You have the legal right to protect your interest for those 6 months. For example: you can change the locks, get fire insurance, board up a broken window. Please Note: Any necessary repairs made on the property during the redemption period require written approval from the treasurer. You may collect rent as well. If it is just land; you may use the land without diminishing its value, for example: you cannot cut down any trees.

14. What if there is a lien or a mortgage on the property?

The Municipality of Cumberland only searches a title for notification purposes only. If we identify a Lien or mortgage, we will notify them prior to the tax sale. It is in the responsibility of the Purchaser to contact a lawyer for further information. The Municipality of Cumberland does not guarantee clear title.

15. What is the size of the lot and where is it located? How accurate are the maps in your information package?

This information can be found at the Upper Nappan Municipal office located at 1395 Blair Lake Road, Upper Nappan. We further provide this information on our website. You can also search www.viewpoint.ca using the PID number provided in the advertisement. Please note that viewpoint is a handy tool but this website is not maintained by the Municipality of Cumberland.

Mapping is a graphical representation of the property boundaries which approximate the size, configuration, and location of the parcels. The map is not a land survey and is not intended to be used for legal descriptions or to calculate exact dimensions or area.

The Municipality of Cumberland makes no representations or warranties to any purchasers regarding the fitness, geographical or environmental sustainability of the land(s) offered for sale for any particular use and does not certify the legal title, legal description, or boundaries. The land(s) offered for sale are being sold on an “as is” basis only, subject to any estates or interest of the Crown in the Right of Canada or the Province of Nova Scotia.

16. What can I build on the property?

It is the responsibility of the purchaser to confirm that the lot parcel is eligible for development. You can contact our Planning and Development department at 902-667-1142 or email at

17. Is there legal access to the property?

The Municipality of Cumberland does not guarantee legal access for tax sale properties. It is the responsibility of the purchaser to confirm if the lot parcel has legal access and/or frontage on a public street/road. You can contact our Planning and Development department at 902-667-1142 or email at

18. When will the deed be ready for pick up?

If the property is a non-redeemable property, the deed will be prepared as soon as possible after the tax sale. If the property is redeemable, it will be prepared when the 6-month redemption period is over. A tax deed can take up to 8 weeks to prepare. Our office will contact you when your deed is ready for pick up from our Upper Nappan Office located at 1395 Blair Lake Road, Upper Nappan NS.

19. Does the property have access to water or sewer?

You will need to contact our office to confirm this. Most properties in Springhill, Parrsboro and Pugwash have access to water and sewer. We will do our best to have this information in the binder and online with the description of the property.

20. What happens if someone is living in the home listed on tax sale?

We are legally entitled, and required, to sell properties for tax arrears in accordance with the Municipal Government Act. If the property is occupied, you should seek legal advice. The Municipality’s role is to collect taxes. Once the property is sold at tax sale, it is up to the new owner to find out their legal rights.

21. Why do some properties have a civic address while others do not?

Sometimes a civic address remains even after a dwelling has been removed from a property. If there was never a building on the property, no civic address would have been assigned. In those cases, you can locate the properties using the maps our office has provided.

22. I don’t see the property on your list that I want to bid on.

Only properties eligible for tax sale are on the list. For eligible properties, they will be on the list once they reach that step in the process. If a property is removed from the list, it is no longer eligible for tax sale.

23. Will I be expected to pay anything more than my bid? Do I need a lawyer?

A $200.00 payment is required at the time you place your bid. If you are purchasing vacant land or a commercially assessed property, HST will be applied to the full bid amount. The only other fee involved in a tax sale purchase is the cost to register the deed. For non-migrated properties, a lawyer is not required, and the registration fee is $100.00. However, if the property is already migrated, you will need a lawyer to complete the registration, and fees will vary depending on the lawyer. While it is not required to have legal representation during the tax sale process, it is always recommended to consult a lawyer when purchasing property.

All properties purchased at tax sale may be subject to a Non-Resident Provincial Deed Transfer Tax on the purchase price. Further clarification can be obtained from the Province of Nova Scotia,

24. What if I receive a tax bill within the 6-month redemption period? Do I need to pay it?

Tax bills are the new purchaser’s responsibility. You should pay the bill to avoid interest on the account. If the property is redeemed, the tax bill will be reimbursed.

25. I am purchasing the property with a friend – how should I record the deed?

Tax deeds being prepared with two or more Grantees can be prepared and recorded as Joint Tenants or Tenants-in-Common.

Joint Tenancy: All owners have an equal and undivided interest in the property. This means that each owner has the same rights to the entire property, and decisions must be made jointly. If one owner dies, their share automatically passes to the surviving owner(s).

Tenancy in Common: Each owner holds a specific share of the property, which can be equal or unequal (e.g., 50/50 or 75/25). Each owner’s share is distinct and can be sold or transferred independently. Upon death, an owner’s share becomes part of their estate and can be inherited by their chosen beneficiaries.

26. Viewpoint is showing a house on the property but your list states land. Is there a house?

Viewpoint and google maps are not always up to date and are not maintained by the Municipality.

If our list states that it is land, then you should go by the information provided by our office.

27. Are the properties surveyed?

Our office does not survey the properties prior to a tax sale. We do not certify the actual dimensions of the property, their use/location on the ground/location of any premises thereon, nor do we express any opinion as to any possible encroachments on the property. All the foregoing can only be determined by survey which is the responsibility of the purchaser.

Municipality of Cumberland Expresses Concern Over Reported Closure of Nappan Experimental Farm

- Details

Cumberland County Mayor Rod Gilroy, on behalf of Municipal Council, is expressing deep concern following reports that employees at the Nappan Experimental Farm have been notified of its impending closure and their resulting layoffs. Agriculture & Agri-Food Canada confirmed earlier this week that significant layoffs were pending, and affected employees living in the area advise that the facility will be closed.

“These are well-paying, skilled federal government jobs that support families and contribute directly to the economic stability of our region,” said Mayor Gilroy. “The loss of employment of this nature hits significantly harder in a rural area like Cumberland County than it does in larger urban centres, where alternative opportunities may be more readily available.”

Mayor Gilroy noted that beyond the immediate impact on employees and their families, the closure would have broader ripple effects on the local economy, including reduced spending and increased pressure on municipal and social services.

On behalf of Municipal Council, Mayor Gilroy is urging federal Agriculture Minister Heath MacDonald to reconsider any decision to close the Nappan Experimental Farm and to engage with employees, the municipality, and the community before taking irreversible steps.

“We are asking the federal government to fully consider the human and regional economic impacts of this decision,” Mayor Gilroy said. “Cumberland County stands with the affected employees and calls for a reconsideration that reflects the importance of these jobs and this facility to our rural community.”

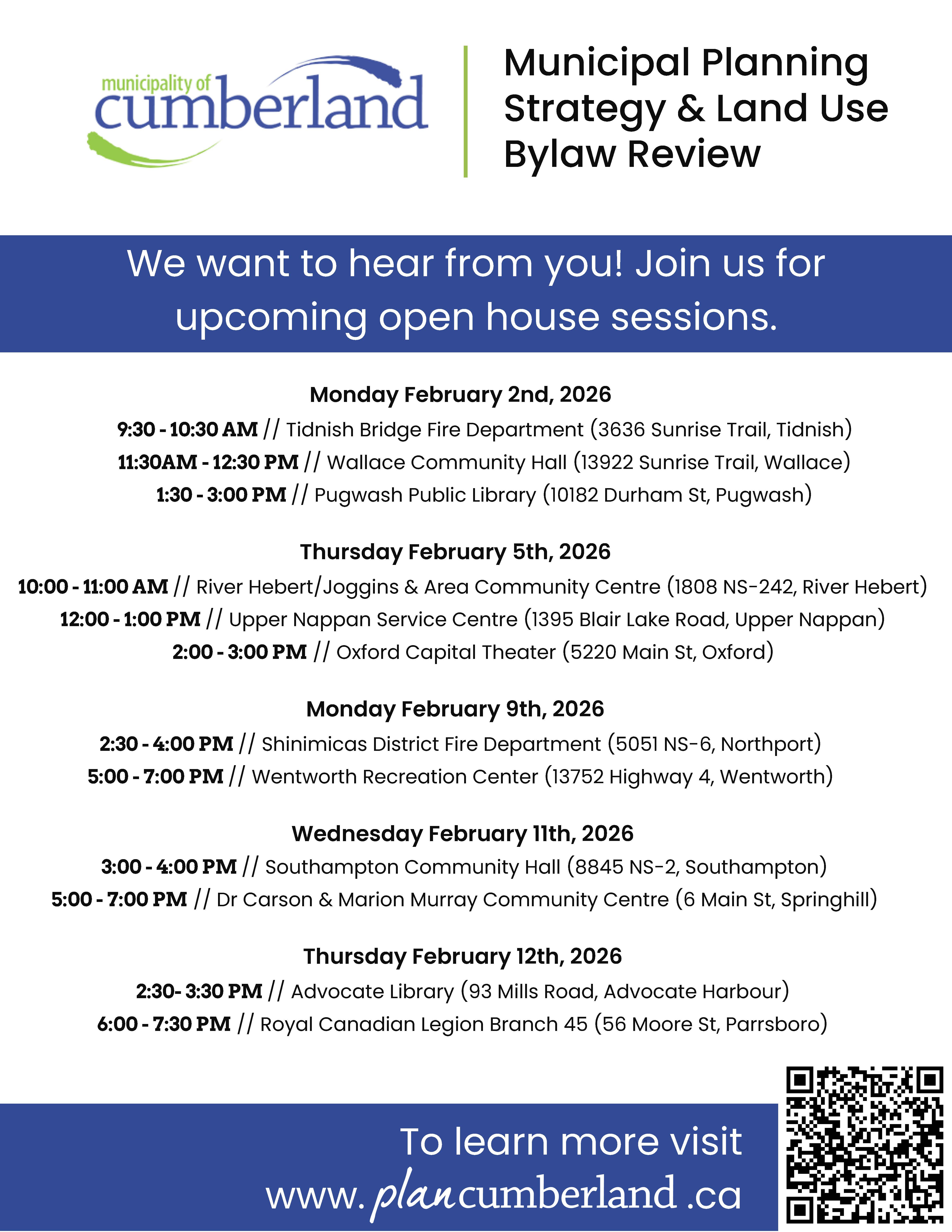

Have your say on the future of the Municipality of Cumberland!

- Details

The Municipality of the County of Cumberland is updating its Municipal Planning Strategy and Land Use Bylaw and this is your chance to help shape how our communities grow and change.

This focused review is all about making sure our planning rules are modern, practical, and reflect what matters most to the people who live, work, farm, and do business here.

We’re looking for community input on four key priority areas that affect everyday life in Cumberland:

- Coastal resilience and protecting our shoreline

• Housing and building balanced neighbourhoods

• Rural and agricultural land use

• Planning for renewable energy

Curious about what this could mean for your community and future development? Come learn more, see the preliminary ideas, and share your thoughts at one of our upcoming open houses.

Learn more at https://www.cumberlandcounty.ns.ca/mps-and-land-use-bylaw-review.html

Open House Schedule

Monday, February 2, 2026

9:30 to 10:30 AM – Tidnish Bridge Fire Department (3636 Sunrise Trail, Tidnish)

11:30 AM to 12:30 PM – Wallace Community Hall (13922 Sunrise Trail, Wallace)

1:30 to 3:00 PM – Pugwash Public Library (10182 Durham St, Pugwash)

Thursday, February 5, 2026

10:00 to 11:00 AM – River Hebert/Joggins & Area Community Centre (1808 NS-242, River Hebert)

12:00 to 1:00 PM – Upper Nappan Service Centre (1395 Blair Lake Road, Upper Nappan)

2:00 to 3:00 PM – Oxford Capital Theatre (5220 Main St, Oxford)

Monday, February 9, 2026

2:30 to 4:00 PM – Shinimicas District Fire Department (5051 NS-6, Northport)

5:00 to 7:00 PM – Wentworth Recreation Center (13752 Highway 4, Wentworth)

Wednesday, February 11, 2026

3:00 to 4:00 PM – Southampton Community Hall (8845 NS-2, Southampton)

5:00 to 7:00 PM – Dr. Carson & Marion Murray Community Centre (6 Main St, Springhill)

Thursday, February 12, 2026

2:30 to 3:30 PM – Advocate Public Library (93 Mills Road, Advocate Harbour)

6:00 to 7:30 PM – Royal Canadian Legion Branch 45 (56 Moore St, Parrsboro)

Your feedback helps guide decisions that will shape Cumberland for years to come. We hope to see you there.